Is your business prepared for an emergency? Do you have a plan of action if your data is hacked? What if an employee suddenly becomes ill?

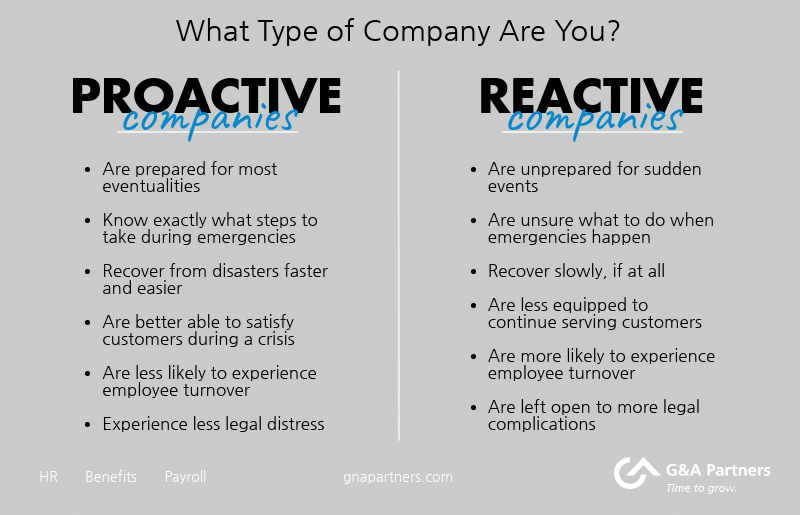

In short: Is your company proactive or reactive?

How to Know If You Are Prepared for an Emergency

Imagine yourself in the following scenarios. Are you prepared for these and other threats to your business operations?

Emergency 1: Your offices are in the path of a massive hurricane. You’ve been ordered to evacuate. How will you keep your business running?

Learn how G&A helped a client recover from Hurricane Harvey.

Emergency 2: A wildfire has cut off access to the office. Your customers, however, still need their services and/or products. How will you keep your clients happy through this crisis?

Emergency 3: A member of your executive team gets into a major car accident and is unable to work for months. She was in the middle of a major deal for your company. How will you continue moving forward while she recovers?

Emergency 4: Someone at your company opened a phishing email and now your data is vulnerable to hackers and ransomware. How will you keep your data safe?

Worried about the safety of your data? Protect your business from cyberattacks: start with our free cybersecurity toolkit.

How a Reactive Company Responds to Disruptions

A reactive company is one that is caught unawares in the event of a disruption to its business operations–anything from a natural disaster to a pipe bursting in the office. These companies have to make all their decisions as a reaction to the disruption, increasing the likelihood that policies may be inconsistently applied and leaving employers more open to legal action. As a result, reactive companies typically have a hard time bouncing back from disruptions of any scale.

How a Proactive Company Responds to Disruptions

A company that prepares for the worst even while times are good is likely to fare the best should an emergency occur. By researching and creating a plan, these companies have explored all the possible hurdles and headaches that might occur and have planned out action items for how to handle those issues. That’s why proactive companies are more likely to recover faster and better than those without a plan in place.

How to Build an Emergency Preparedness Plan for Your Business

Whether your region is prone to hurricanes, floods, tornadoes, wildfires, or earthquakes, there are several steps you can take to prepare and protect your business in the event of an emergency:

Create a preparedness team.

A great place to start when creating an emergency preparedness program is to create an emergency response team. If, for some reason, your office was inaccessible, who are the people you’d need on hand to ensure your doors remained open? These key employees will make up your emergency response team and will be involved in all steps of the preparedness policy including development, implementation, and assessment.

Identify your weaknesses.

The best way to identify your business’s weaknesses is to assess them. Conduct a risk assessment to identify any potential hazards and what could happen in the event of each hazard. Once you’ve identified your risks, analyze the possible ramifications a hazard could have on your business using a business impact analysis (BIA).

Develop a plan.

There are several different plans your business may want to develop:

- Emergency Response Plan: This document will outline the steps your business will take in the immediate aftermath of a disaster.

- Crisis Communications Plan: There are likely several key groups you will need to contact after your business has started the disaster response process. This document will list how you will contact your employees, customers, vendors, and any other groups that are affected.

- Business Continuity Plan: Every day your business is disrupted equals lost revenue. This document will outline how your company will operate until it has fully recovered.

- IT Disaster Recovery Plan: How would your business survive losing all of its computers?

Conduct emergency drills.

Practice makes perfect. Review the emergency policy with your employees on at least an annual basis, and have regular emergency drills.

Your business may never be the victim of a natural disaster or emergency, or your business may flood tomorrow. Emergencies and disasters are, by nature, unpredictable. The best way you can protect your company is by planning for every contingency now. With the right emergency response, communications, and continuity plans in place, your business will be able to weather almost any storm.

How G&A Can Help

G&A Partners helps our clients prepare for all kinds of potential risk and safety concerns by developing sound HR policies and procedures. Don’t leave your business unprotected – contact G&A Partners today to learn how we can help you minimize cost, increase productivity, and reduce risk.