Whether you’ve just signed your client service agreement (CSA) with G&A Partners or you’re preparing to take that final step, partnering with a professional employer organization (PEO) marks the beginning of an exciting new chapter for your business. The next phase—the PEO onboarding process—is where your relationship with G&A takes shape and the groundwork for long-term success is built.

Throughout onboarding, your G&A team will work closely with you to gather data, integrate systems, set up payroll, and facilitate benefits enrollment. This process typically spans five to seven weeks. During this time, your business will continue operating under its current payroll and HR structure—whether managed in-house or through another human resources outsourcing provider—until G&A runs your first payroll and onboarding concludes.

To help you prepare for this exciting next step, we’ll walk you through what to expect during the onboarding phase at G&A Partners—from the time you sign your CSA to the weeks after your first payroll is processed.

Let’s get started!

Meet Who You’ll Work With During the G&A Onboarding Process

As you move from the PEO sales process into implementation, your G&A Partners business advisor will meet with your newly assigned onboarding project manager to discuss your business’s needs, the desired first payroll date, and the services included in the CSA.

From that point forward, the onboarding project manager will become your primary point of contact—leading you through each step of the onboarding phase. They will outline the roles and responsibilities for both your business and the G&A team, set milestones that align with the first payroll date, and keep the process on schedule from start to finish.

The G&A onboarding team is curated based on your organization’s specific needs and services. In addition to the project manager, your team may include:

- Client Advocate: Manages the overall relationship between you and G&A and will become your dedicated account specialist after the onboarding phase.

- Payroll Analyst: Implements all aspects of your company’s payroll on the G&A platform.

- Benefits Specialist or Benefits Account Manager: Manages open enrollment and benefits administration.

- Trusted Advisor or Insurance Broker: May participate to stay informed during the implementation process.

- Service Team Specialists: Depending on your contract, your team may also include:

- 401(k) Specialist

- Time & Labor Management Analyst

- HR Advisor

- IT Solutions Specialist

What to Expect During PEO Onboarding Process

The PEO onboarding process involves a lot of moving parts, but with a detailed plan and a dedicated team behind you, the experience should feel smooth and structured. G&A and your internal team will each have defined responsibilities and deadlines, and your onboarding project manager will space out milestones and provide guidance along the way—keeping the process organized, transparent, and manageable.

Throughout onboarding, providing requested information by agreed-upon dates is important for two key reasons:

- Accurate data drives setup success. The information your team shares—such as employee details, benefits selections, and payroll data—forms the foundation we will use to deliver HR services tailored to your organization. Incomplete or inaccurate information can cause delays or errors.

- Timely collaboration keeps onboarding on track. Meeting milestones helps you and your onboarding team stay aligned and ensures a smooth path toward your first successful payroll with G&A.

The length of the onboarding phase can vary depending on several factors, including:

- Number of employees

- Payroll complexity

- Technology needs, such as custom integrations with existing systems or intricate time and labor requirements

On average, new G&A clients complete onboarding in about six weeks—from the initial kickoff call to the first payroll. A company with fewer than 50 employees may finish the process in four to five weeks, while a business with 900 workers will require additional time. Each timeline is customized to ensure accuracy, compliance, and a seamless transition.

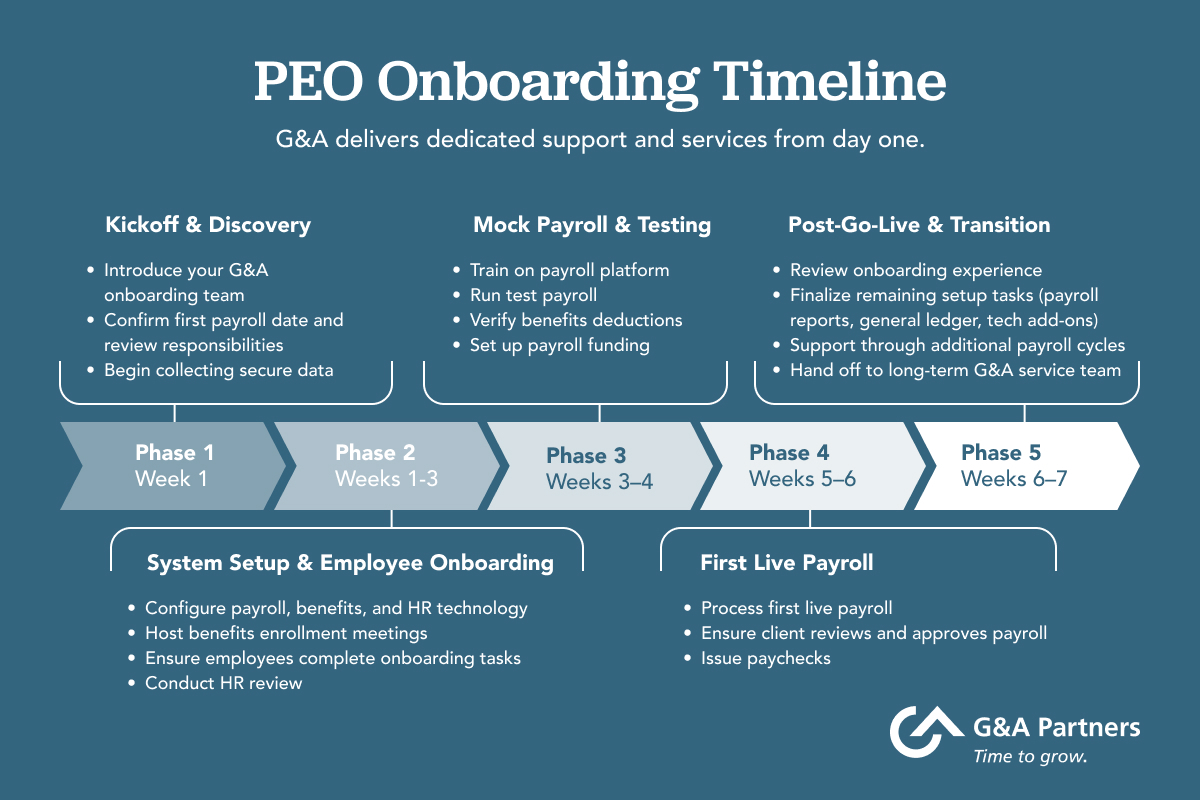

At G&A, the onboarding process unfolds in five structured phases.

Getting Started: Kickoff Call and Discovery

Phase 1 of the onboarding journey begins with preparation and a kickoff meeting that sets the stage for a well-organized transition. Within about one week of signing your CSA, your G&A business advisor and onboarding project manager will connect to review your goals. The onboarding project manager will then contact your team for a formal introduction and to schedule the kickoff call.

After the meeting is scheduled, your onboarding project manager will share the agenda and confirm attendees.

Phase 1 includes:

Kickoff Call: In this important meeting, your team will:

- Meet the G&A onboarding team

- Receive an overview of the timeline and critical deadlines

- Discuss and finalize the first payroll date

- Review the roles and responsibilities of your team and G&A

- Become familiar with G&A’s secure data exchange platform

- Schedule discovery meetings for various services, such as benefits, payroll, HR technology, and 401(k)

Data Collection: Following the kickoff, your team and G&A will begin sharing documents using the secure data exchange platform. For example, your team can expect to gather employee census data, while G&A may send documents to your team to complete and/or sign. This step lays the foundation for configuring payroll, benefits, and compliance systems accurately.

G&A TIP: Before the kickoff meeting, review the agenda and invite team members who have knowledge of the agenda topics being discussed—such as those who manage payroll or benefits. Also, it’s a good idea to include an individual with decision-making authority. Having all key people in the room helps your onboarding team gather accurate information and keeps the process running smoothly.

Building a Foundation for Success: System Integration, Employee Onboarding, and Training

With your kickoff complete, Phase 2 focuses on setting up systems, training your team, and preparing your employees to onboard into G&A’s platform. This step ensures every component—payroll, benefits, and HR technology—is configured correctly before your first payroll run.

Phase 2 includes:

- System and Payroll Configuration: G&A begins setting up its HR technology platform, including granting administrator access to designated team members, configuring benefits and retirement plans, and setting up additional modules for optional services.

- HR Technology Training: G&A provides initial training and resources tailored to your service offerings, so your administrators feel confident navigating the system.

- Benefits Informational Meetings: G&A’s benefits team hosts informational sessions with your employees to review their new benefits offerings, outline open enrollment deadlines, and answer any questions.

- Employee Onboarding: Because G&A becomes the employer of record for your workforce, each team member will need to complete employee onboarding tasks within G&A’s platform.

- HR Review: As the G&A onboarding team prepares to set up payroll, a high-level HR review will be conducted to identify potential employee misclassifications, ensure exempt workers meet Fair Labor Standards Act (FLSA) requirements, and verify that hourly wages meet local, state, or federal minimum wage requirements. In needed, the team will recommend any actions required to become compliant.

G&A TIP: During this phase of the PEO onboarding process, take time to educate your employees on what a PEO is, why you’ve chosen G&A, and how the partnership benefits both them and the organization. Remind them to complete onboarding and benefits enrollment by the stated deadlines so they can experience the full value of a PEO as quickly as possible. You can conveniently monitor their progress in G&A’s onboarding system.

Preparing for a Successful Launch: Mock Payroll and Testing

Phase 3 is where preparation meets practice. During this stage, G&A’s onboarding team and your internal payroll contacts will work together to ensure all systems are configured correctly and your team feels comfortable using the platform. This phase allows both teams to test, train, and fine-tune before your first live payroll.

Phase 3 includes:

- Payroll Training: G&A provides a dedicated training session focused on navigating the payroll platform and performing essential tasks—such as entering, reviewing, and approving payroll, as well as generating reports.

- Payroll Test: The G&A team runs a mock payroll and additional tests to ensure the system is properly configured. This step will take additional time for larger organizations or businesses with complex payroll structures.

- Benefits Enrollment Review: G&A reviews all benefits and 401(k) enrollments and confirms that corresponding deductions are entered correctly in the system.

- Payroll Funding Setup: The onboarding project manager confirms that your banking information has been entered into the system and verifies wire instructions have been provided to your business. The manager will also confirm that the reverse wire setup has been completed.

G&A TIP: Payroll training is the perfect time to ask questions, clarify instructions that seem unclear, and discuss your team’s role in the process. The more confident your team is at this stage, the smoother your first payroll will run.

Celebrating a Major Milestone: First Payroll

Phase 4 marks a major milestone—the successful processing of your first payroll with G&A Partners. At this stage, all systems have been tested and approved, and your G&A onboarding team works closely with you to ensure payroll runs accurately and on schedule.

Phase 4 includes:

- Payroll Processing and Approval: On the agreed upon payroll date, the G&A team processes your first payroll and sends it to your team for review and approval.

- Payroll Funding and Paychecks: Your team provides the necessary funds for payroll. Once funding is confirmed, the G&A team finalizes payroll and issues the first checks.

G&A TIP: Remind your employees when their first paychecks will be issued. Encourage them to review their pay stubs carefully to confirm that personal information, pay rates, and deductions are correct. Addressing questions early helps ensure a smooth transition for everyone.

Continuing the Journey Together: Transition to Long-Term Support

The final phase of onboarding focuses on refinement, review, and a smooth handoff to your long-term G&A service team. During this stage, your onboarding project manager ensures every system, report, and process is functioning seamlessly—and that you feel confident moving forward with day-to-day HR operations.

Phase 5 includes:

- Post-Go-Live Review: Your onboarding project manager meets with you after the first payroll to debrief, answer any questions, and gather feedback about your experience with the G&A PEO onboarding process.

- Complete Outstanding Onboarding Tasks: Some onboarding tasks—such as setting up a general ledger—can’t be completed until after the first payroll. During this phase, your team and G&A tackle these remaining items. Common to-dos include fine-tuning payroll reports or implementing additional HR technology, such as applicant tracking. The G&A team will also review payroll reporting with you in more detail, now that payroll data is available to examine.

- Process Additional Payrolls: To ensure payroll is running smoothly, the onboarding team will continue supporting your team through a couple of payroll cycles before transitioning your organization to its dedicated service team. The team will also verify that the payroll process is fully documented.

- Transition to Ongoing Service Team: Once all services have been implemented, your onboarding team will officially transition your account to your long-term G&A service team. Your dedicated client advocate or client success manager becomes your primary point of contact for ongoing support.

G&A TIP: Even after you’ve transitioned to long-term support, you may continue to work with your onboarding team on special projects or business changes. For instance, companies that expand into new locations or acquire other businesses often reconnect with their onboarding specialists to ensure a seamless setup for new employees.

Tools and Resources to Help You Navigate the PEO Onboarding Process

Now that you’ve seen how each phase of onboarding unfolds, it’s helpful to know what resources are available to support you along the way. G&A provides a suite of tools, technology, and expert guidance to make the process easier and more efficient for both you and your employees.

These include:

- Knowledgeable HR Experts: G&A’s onboarding team includes experts with extensive HR experience—ready to help you tackle even the most complex employment-related challenges. From payroll and compliance to benefits administration and more, our team is here to answer questions and offer guidance. (Once onboarding concludes, your dedicated service team will continue providing expert HR support.)

- Data Exchange Tool: A secure, easy-to-use platform for sharing documents and data with G&A.

- Employee Communication Templates: Ready-made templates help you introduce G&A to your team, explain what a PEO is, and share key onboarding and benefits enrollment dates.

- Webinars and/or employee meetings: As part of benefits open enrollment, G&A offers webinars or in-person sessions where your employees can learn about plan options and ask questions.

- Onboarding Platform: You’ll start using G&A’s HR technology platform right away to track employees’ progress of onboarding tasks.

- HR Technology Training: Step-by-step videos, guides, and in-person training sessions show you how to navigate G&A’s HR technology system and perform essential tasks—such as approving payroll or managing employee data.

Common PEO Onboarding Pitfalls and How to Avoid Them

Even with a detailed plan and expert support, every onboarding process comes with learning curves. The good news? Most challenges are easy to avoid with clear communication, realistic timelines, and active collaboration between your team and G&A.

Here are a few common hurdles new clients may encounter—and how to stay ahead of them:

- Delayed data collection: G&A’s onboarding team requires essential data—such as census information and completed new-employee paperwork—before processing the first payroll. Providing data by the suggested deadlines helps ensure your first payroll runs on time.

G&A TIP: If you’re unsure how to access specific data, reach out to your G&A Onboarding team—they’re happy to walk you through it.

- Setting an aggressive first payroll date: Rushing the onboarding phase can lead to incomplete system setups or data errors. Plan for at least six weeks between the date you sign your CSA and processing your first payroll. Larger companies or businesses with complex payroll or system requirements may require several months.

G&A TIP: If your current provider’s contract or benefits coverage is ending soon, begin exploring PEO options several months in advance. That way, you’ll have plenty of time to complete onboarding without service gaps.

- Misalignment on roles and expectations: Though a PEO does handle a significant portion of back-office administration and provide valuable guidance, your team will continue to manage HR-related decisions—like performance reviews, hiring, setting work schedules, and job-specific training.

G&A TIP: In your kickoff call, work closely with your onboarding team to clarify roles and responsibilities on both sides. Clear alignment early on prevents missed steps later.

- Employee confusion: Your employees may be unfamiliar with what a PEO does or how co-employment works. G&A can provide resources, such as communication templates, to help educate your employees about the role of a PEO.

G&A TIP: Highlight how partnering with a PEO will improve the employee experience. Give your team examples of when to contact G&A versus an internal team member for help.

- Insufficient systems training: Partnering with a PEO gives you access to advanced HR technology. While some systems may be familiar to your team, you’ll still need to dedicate time to training and setup. Make sure team members review training resources, have appropriate access levels, set up their logins, and can navigate essential functions.

G&A TIP: G&A will manage many day-to-day HR tasks on your behalf, but you’ll still need managers or a designated individual to perform certain functions—such as approving payroll or vacation requests. Make sure your team members have the training they need to perform these functions. - Over-customizing before the first payroll: The onboarding phase lays the foundation for your long-term success, so focus on getting core functions—like payroll and benefits—right first. Save process improvements, handbook updates, and technology expansions for after onboarding is complete.

G&A TIP: Once onboarding wraps up, you’ll have plenty of time to explore additional HR technologies and strategic initiatives with your G&A service team.

What to Expect After Onboarding Ends

Completing the PEO onboarding process is just the beginning. Once onboarding wraps up, your partnership with G&A Partners shifts from setup to long-term success. You’ll begin to experience the full value of your PEO relationship—through streamlined processes, proactive support, and access to expert HR resources that empower your business and your people.

Here’s what you can expect once onboarding ends:

- Timely, accurate payroll. G&A’s payroll specialists processed payroll with 99.9% accuracy in 2024. That means you can be confident your employees will be paid correctly and on time.

- Self-service tools that save time. Your team can perform more HR functions on their own through G&A’s HR technology platform, freeing up valuable time in everyone’s schedule.

- Fewer compliance headaches. Seek guidance from G&A’s compliance team to ensure your policies and procedures are compliant and you’re staying current with evolving employment laws and reporting requirements.

- Responsive, knowledgeable employee benefits support. G&A’s benefits team answers employee questions and assists with day-to-day needs—such as accessing plan information and requesting benefits cards.

- An expert partner for strategic HR. You can lean on your G&A team to share best practices and offer guidance on big-picture strategic initiatives, such as improving retention or managing complex employee relations.

- Stress-free tax management. G&A will manage your employment-related tax requirements (such as deductions, quarterly filings, tax remittance, W-2s, and more), giving you peace of mind that deadlines are met and filings are accurate.

- Improved recruiting and retention with competitive benefits. Businesses utilizing one of G&A’s benefits plans often experience lower turnover and greater success attracting top talent.

At G&A Partners, we’re genuinely excited to begin this partnership and to support your organization as it grows and evolves. The onboarding phase is just the start of a lasting relationship—one built on collaboration, trust, and a shared commitment to helping your business and your people thrive for years to come.