As your business grows, so does the complexity of managing HR. Tasks like payroll, benefits, and compliance can quickly consume valuable time and resources—taking your team away from strategic and revenue-generating efforts. Partnering with a professional employer organization (PEO) gives small and mid-sized businesses access to expert HR services and support, modern technology, competitive benefits options, and more. This is made possible through an arrangement called co-employment.

To help you better understand this model, we’ll walk through what co-employment is, how it works in practice, and the advantages it can bring to your business and employees. We’ll also address potential risks and share strategies for building a strong, successful partnership with a PEO.

Co-Employment Defined: The Basics

Co-employment is a concept that is sometimes misunderstood, so it’s important to know up front that entering into a co-employment arrangement with a PEO does not mean you lose control over any part of your business. It is simply a structure that defines how administrative responsibilities are shared between your company and a professional employer organization.

Understanding how co-employment works starts with the basics: what it is, when it begins, and the respective roles of the business and the PEO. Let’s get into the details.

Co-Employment Definition

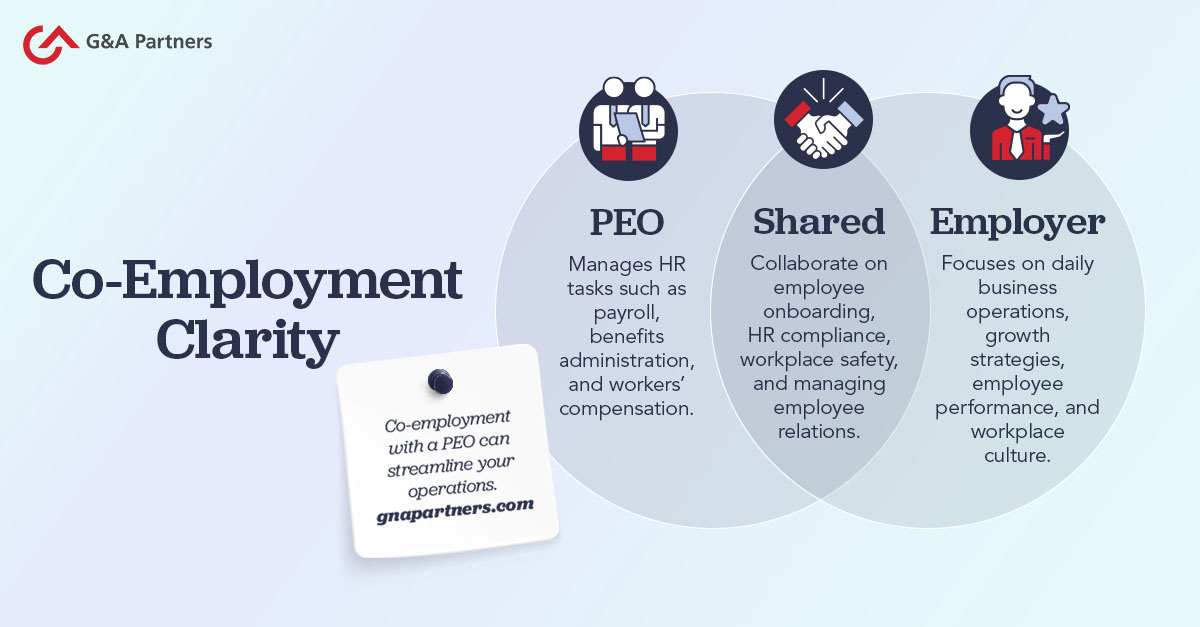

When you engage a PEO, you enter a co-employment relationship that allows the PEO to handle HR administrative tasks on your behalf, such as HR management, payroll processing, payroll tax remittance, and benefits administration. At the same time, you continue managing your employees, handling operations, and making all business decisions. Through the co-employment model, a PEO gives you time back to focus on your core business, rather than spending valuable hours on HR.

When Does Co-Employment Begin?

The co-employment model officially begins once you sign a client service agreement with a PEO. However, in the first several weeks, your business will continue to complete HR-related tasks until your onboarding phase ends and your PEO processes your first payroll within its system. At that point, the PEO becomes the co-employer of your employees for administrative purposes, while you retain full authority over business operations.

Role of the Business vs. the PEO

In a co-employment relationship, you and your PEO share specific responsibilities over your employees. Your company focuses on running the business—hiring, managing, and leading employees—while the PEO provides the behind-the-scenes HR expertise and technology. This balance allows you to retain control over your workforce while gaining access to advanced HR tools and services, Fortune 500-level employee benefits packages, compliance guidance, and more.

The table below outlines some typical business-related responsibilities and who would handle each under a co-employment agreement with a PEO:

| You & your business | Business Responsibilities | Your PEO |

|---|---|---|

✔ |

Makes personnel decisions |

|

✔ |

Manages operations |

|

✔ |

Makes business decisions |

|

Onboards new employees |

✔ |

|

Provides and supports HR-related technology |

✔ |

|

Withholds and remits payroll taxes |

✔ |

|

Processes payroll & delivers paychecks, direct deposits |

✔ |

|

✔ |

Sets wages & salaries |

|

✔ |

Determines company holidays and PTO policy |

|

✔ |

Chooses benefits plans to offer employees based on needs & budget |

|

Administers employee benefits |

✔ |

|

Provides workers’ compensation and manages claims |

✔ |

|

✔ |

Supervises employees on daily basis |

|

✔ |

Manages company and departmental budgets |

|

✔ |

Remits corporate taxes |

|

Provides regulatory guidance on workplace-related requirements |

✔ |

|

✔ |

Responsible for compliance with workplace-related requirements |

|

Processes and distributes W-2s |

✔ |

|

Answers HR-related questions for employees |

✔ |

|

Provides strategic guidance on HR matters |

✔ |

Co-Employment vs. Joint Employment: What’s the Difference?

Business leaders often ask what a joint employer is and whether it’s the same as co-employment. While the terms may sound similar, they describe different arrangements.

A joint employment relationship occurs when two or more businesses share responsibility for an employee’s terms and conditions of work. This often arises in staffing agency or contractor relationships, where multiple employers are considered legally responsible for the same employee.

Co-employment, on the other hand, is a voluntary arrangement with a professional employer organization (PEO). In this model, your company maintains control of business operations and workforce management, while the PEO handles HR administration and provides support services. The result is reduced administrative burden and access to resources that help your company grow.

The table below highlights some of the key differences:

Co-Employment |

Joint Employment |

|

|---|---|---|

Definition |

A contractual relationship between an employer and a PEO where administrative responsibilities are divided. |

Two or more employers simultaneously employ an individual and share legal responsibility over the employee. |

Purpose |

To help businesses offload HR administrative tasks, reduce compliance risks, and gain access to affordable, competitive benefits and expertise. |

To ensure workers are protected by holding multiple employers accountable for wages, hours, and working conditions. |

Legal Responsibility |

Employer manages business operations; PEO provides compliant employee pay, benefits, and HR guidance. |

All employers are responsible for compliance, pay, and workplace rights. |

Risk Sharing |

Risks are minimized through defined roles; certified PEOs (CPEOs) provide added protections. |

Liability and risk are not necessarily shared equally and may be determined by the degree of control each employer has over essential terms and conditions of employment. This can create legal complexity. |

How the Relationship is Formed |

Voluntarily through a client service agreement with a PEO. |

May arise voluntarily (staffing/outsourcing) or be determined by law or courts. |

Impact on Employees |

Employees gain access to expert HR support, better benefits, and streamlined technology and services. |

Can improve worker protections by holding more entities accountable for wages, safety, and labor law compliance; can create complexities in the workplace when multiple employers are responsible for their rights. |

Examples |

A business partners with a PEO for HR administration. |

Often seen in a contractor-subcontractor relationship, or when a staffing agency places temporary workers with a company. |

What Does Employee Leasing Mean?

Employee leasing is another model that is sometimes confused with co-employment. In employee leasing, a third-party company provides temporary workers who are then “leased” back to your business. These individuals are not your permanent employees, and the leasing company typically controls the employment relationship.

In a co-employment model, your workers remain permanent employees of your company. You set their roles and responsibilities, while the PEO manages HR administration.

Common Misconceptions About Co-Employment

When business owners first hear the term “co-employment,” it can raise more questions than answers. Does it mean losing control? Will it confuse employees? In reality, co-employment is designed to reduce complexity and strengthen your business. Below are some of the most common myths, along with the facts you should know:

Myth |

Reality / Fact |

|---|---|

In co-employment, a PEO takes over your employees. |

You still maintain full authority over hiring, terminations, promotions, and your team’s direction. The PEO’s role is administrative (payroll, benefits, etc.) and supportive guidance — not managing your business operations. |

Co-employment increases legal risk. |

Working with a PEO often reduces compliance risk. A reputable IRS-certified PEO (CPEO) helps you stay updated with the latest regulations, file payroll taxes accurately, and handle benefits administration correctly. |

Employees won’t understand or like co-employment. |

Most employees notice improvements: faster response times, more reliable HR services, better benefits, and integrated technology. They still report to you, while enjoying HR support behind the scenes. |

I’ll lose my HR team or internal capability. |

Co-employment doesn’t eliminate your HR staff — it frees them. Instead of being tied down to manual admin, they can focus on strategy (training, culture, retention, leadership development). The PEO acts as your support, not a replacement. |

Co-employment is just temporary staffing or leasing. |

Employee leasing means hiring workers through another company, often temporarily. Co-employment with a PEO means your existing employees remain yours, with you directing culture and operations. The PEO handles certain administrative functions under contract. |

Benefits of a Co-Employment Relationship

Advantages of the co-employment model extend beyond streamlining HR administrative tasks. Here are some of the most valuable benefits business owners can expect:

- Access to Fortune 500-Level Benefits: A PEO’s group buying power gives small to mid-sized businesses the ability to offer robust, employee benefits packages that help you attract and retain top talent.

- Reduced Compliance Risk: Regulatory experts at a PEO, like G&A Partners, monitor labor laws and provide guidance to help you avoid compliance risks and penalties.

- Lower Costs: A PEO uses scale and expertise to deliver competitive benefits, HR services, and technology at a fraction of what it would cost your business to provide on its own.

- Improved Employee Satisfaction: Access to better benefits, training, and HR support helps boost employee satisfaction and reduce employee turnover.

- Better HR Technology: You gain a suite of integrated HR technology from time- tracking to learning management systems that streamlines daily HR tasks.

- More Time for Strategy: Business leaders can focus on growth and innovation instead of HR tasks and administrative responsibilities.

Co-Employment Risks and How to Manage Them

Like any business model, co-employment comes with risks. However, most can be avoided or mitigated with the right partner and proactive practices. Recognizing the risks upfront allows you to build safeguards into your PEO relationship and protect your business and employees.

Below are potential risks and how you can avoid them:

- Risk: Choosing the wrong partner.

Solution: Thoroughly vet providers, review references, and confirm industry expertise before signing an agreement. - Risk: Data security concerns.

Solution: Ensure your PEO uses strong encryption, compliance certifications, and strict data privacy protocols. - Risk: Unclear responsibilities.

Solution: Ask potential PEOs to clearly define each party’s role in the service agreement and revisit these responsibilities regularly to avoid gaps. - Risk: Compliance mistakes.

Solution: While your business ultimately remains accountable, a certified PEO can provide expert guidance and monitor federal and state requirements. Regular compliance reviews and transparent reporting further reduce risk. - Risk: Wage-base restart.

Solution: If you leave a CPEO for a noncertified provider, payroll tax wage bases (for Social Security, FUTA, FICA) may reset if you switch mid-year—potentially increasing costs. Prevent this by confirming your provider’s certification status before making a switch. You can also mitigate this by switching providers on January 1.

Best Practices for a Successful Co-Employment Relationship

A successful co-employment relationship depends on open communication, clearly defined roles, and consistent oversight. By following these co-employment dos and don’ts, you’ll set the foundation for smoother operations and better outcomes for your workforce:

Co-Employment DOs

- Do understand the PEO’s role – what they can handle on your behalf and what remains your responsibility. For example, a PEO can advise on employees’ wage complaints but cannot resolve them for you.

- Do discuss the latest workplace laws with your PEO to better understand how these regulations impact your business.

- Do ask for a detailed list of PEO services and define responsibilities in the service agreement before signing a contract.

- Do trust your PEO as an experienced HR partner who can support strategic initiatives and help elevate your employee experience.

- Do tap into the full expertise of your PEO team, from employee relations and workers’ compensation to safety and compliance.

- Do review the PEO’s HR technology to ensure it is compatible with your systems.

Co-Employment DON’Ts

- Don’t rely on your PEO to create employee policies. A PEO can advise you on best practices and guide you, but the policies must come from you.

- Don’t ask your PEO to discipline or terminate employees. They can, however, guide you through the process.

- Don’t expect your PEO to file and pay your corporate taxes. A PEO only handles payroll-related taxes on your behalf.

- Don’t avoid tricky employee situations; lean on your PEO for expert guidance.

- Don’t forget to ensure the accuracy of the payroll data you provide your PEO, so they can properly process it and remit payroll taxes.

- Don’t disengage from HR entirely—stay actively involved in shaping your company’s culture and people management.

Real-World Example: How Co-Employment Lessens Your Burden

The best examples of co-employment come from small-business owners who know first-hand the benefits of using a PEO. Take Torrey Hawkins, president of Angler Construction and Bayou City Angler, who turned to G&A Partners for HR expertise.

By outsourcing HR, payroll, and benefits administration, Torrey was able to secure better benefits pricing for his employees, free up time, and build enough capital to focus on his passions—growing his construction company and launching Houston’s only specialty fly-fishing shop.

Discover more client stories from G&A Partners or dive into our case studies for more examples of co-employment and how it has benefited our clients.

Is co-employment right for your business?

Now that you have a clearer picture of what co-employment is and how it works, the next step is deciding if it’s the right fit for your business. Here are a few signs that co-employment may be the right solution for you:

- You’re preparing for rapid growth, or your business is already expanding, and HR demands are outpacing resources.

- You’re hiring across multiple states and concerned about keeping up with complex compliance rules.

- You want to reduce HR overhead costs while maintaining high-quality services.

- You don’t have an in-house HR department.

- You want to offer better, more comprehensive benefits to attract and retain talent.

- You need compliance expertise and guidance to help manage risk (workplace safety, labor laws, or employee relations).

Co-Employment Can Be a Strategic Advantage

Co-employment gives small and mid-sized businesses access to HR resources, expertise, technology, and employee benefits that are often out of reach on their own. With the right PEO partner, you can streamline operations, improve the employee experience, and reduce risk. G&A Partners can help you focus on growth while ensuring your people are supported and positioned for long-term success.

How G&A Can Help

Ready to simplify HR and grow your business? Schedule a free consultation to learn how co-employment with a certified PEO can help.

Co-Employment FAQs

How does co-employment affect tax filings?

A PEO handles payroll tax filings for your employees under its own EIN, while you maintain control of wage and compensation decisions.

Who is the employer of record in a co-employment relationship?

In this situation, the PEO becomes the employer of record to perform HR tasks on behalf of the client. However, an employer of record (EOR) can also refer to a type of HR outsourcing provider that legally employs global workers on their client’s behalf. You can learn more about the differences between EOR and PEO here.

How do I choose the right co-employment partner or PEO?

Evaluate certification status, industry expertise, technology compatibility, and client support before signing an agreement.

Is co-employment legal?

Yes. Co-employment is a fully legal business model recognized by the IRS. Many PEOs, including IRS-certified PEOs (CPEOs), operate under strict regulations to ensure compliance.