If you’re feeling stretched thin managing payroll, benefits, compliance, and risk management alongside your core business functions, you're not alone. Many small and mid-sized businesses owners face this daily juggling act. And it’s one of the many reasons more companies are seeking out cost-effective alternatives, like outsourcing HR to a professional employer organization (PEO).

Yet, like any business decision, you may be deliberating the true benefits of a PEO and whether it justifies the investment. In this article, we delve into the value and impact of PEOs, exploring the return on investment (ROI) of a PEO partnership and the myriad of benefits they offer.

What are the benefits of using a PEO?

Partnering with a PEO gives your company access to comprehensive HR services and solutions, relieving you of administrative burdens and allowing you to prioritize innovation and growth, strengthen your company culture, and ensure your employees feel valued and supported. And the benefits of using a PEO don’t end there.

Cost savings can also be realized by:

- Consolidating outsourced HR services: As businesses evolve, they often start by outsourcing a single HR service, such as payroll. As needs grow, however, multiple services may be outsourced to different vendors. Consolidating these services with a PEO can lead to cost savings.

- Reducing the high cost of turnover: With a PEO, you have access to better, more affordable benefits and HR experts who can help you elevate the employee experience. Both are key to improving retention – a costly, yet persistent problem for small businesses.

- Scaling your HR as your business grows: Expanding your business – and ensuring your HR needs are still met – is easier with a PEO (and less costly) than hiring more in-house HR employees.

There are also “big picture” benefits of working with a PEO. Research has shown that organizations leveraging a PEO are 50% less likely to go out of business; additionally, these companies grow at a rate 7% to 9% faster than their non-PEO counterparts. They also have more empowered and productive employees, which helps businesses lower their turnover rate by an average of 14 to 16%.

How do PEOs generate ROI for businesses?

While no two PEOs are the same, their means for generating a positive ROI are generally consistent, centering around a few key areas:

- Enhancing HR functions—while reducing your costs.

Utilizing a PEO and its resources leads to streamlining and optimizing daily HR tasks and increasing efficiencies, without the costs of hiring an in-house HR team.

- Providing the type—and scope—of competitive employee benefits that will attract (and retain) key talent. Offering a comprehensive benefits package can be a real differentiator when it comes to finding (and keeping) top talent.

- Strengthening risk management policies and procedures to maintain regulatory and legal compliance. When working with a PEO, the ROI related to workplace regulations is simple: reduce or eliminate noncompliance violations and potentially save money by avoiding costly fines, penalties, or lawsuits.

How much does a PEO cost per employee?

According to recent research by the National Association of Professional Employer Organizations (NAPEO) the average PEO cost per employee is $1,395 annually. It’s important to note that the per-employee cost of working with a PEO will vary depending on factors related to your business as well as the PEO provider you opt to work with. The scope of services also matters.

It’s also worth noting that some PEOs may charge on a percentage-of-payroll basis (rather than per-employee). In these instances, the cost amounts to roughly 3-12% of your organization’s total payroll per pay period.

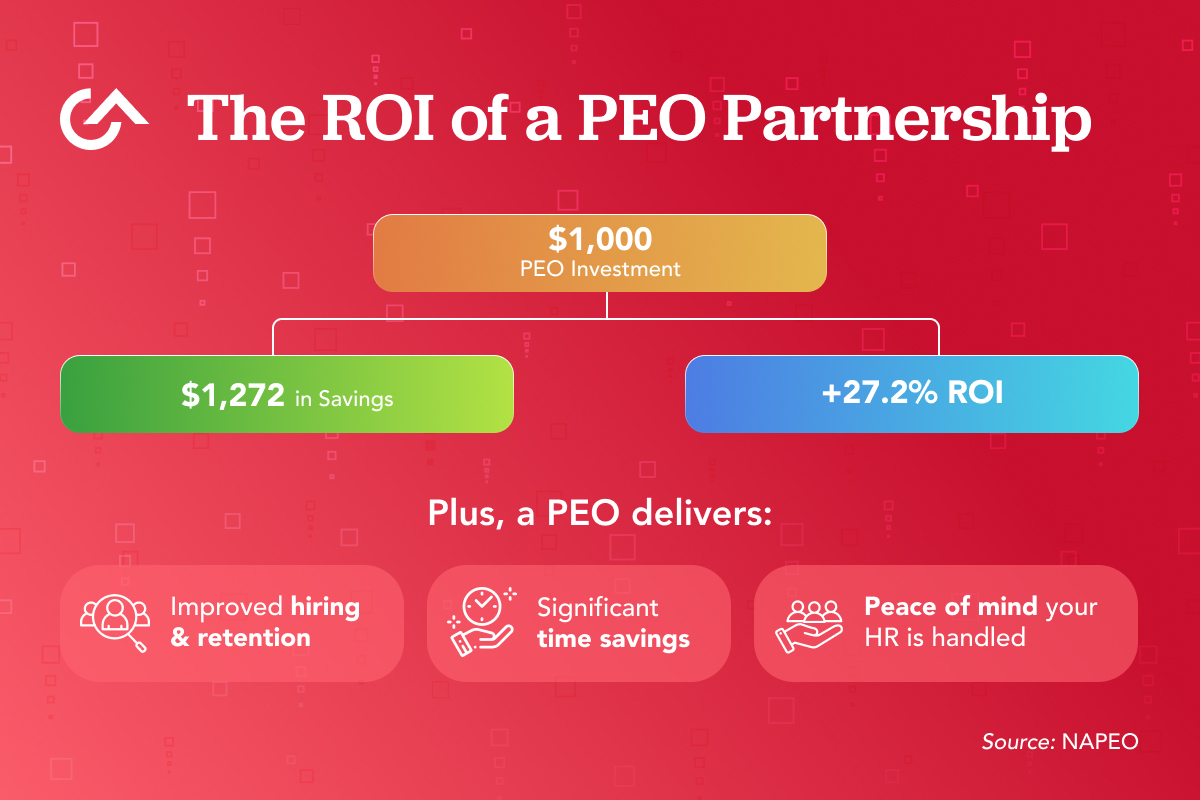

What is the ROI of using a PEO, and how is the ROI of a PEO calculated?

According to NAPEO’s research, the average ROI of working with a PEO is just over 27%. So, while you may be spending an average of $1,395 per employee (as noted above), you’re saving

an average of $1,775 each year.

While calculating the exact ROI of working with a PEO can be tricky (due to the wide range of variables involved), you can use the following formula to calculate a ballpark figure:

- First, you’ll need to estimate the cost savings per employee and cost per employee.

- Next, subtract cost per employee from the per-employee cost savings figure.

- Divide that number (the difference) by the cost per employee, and then multiply the result by 100 — that figure is the ROI percentage.

Here’s an example: Let’s say working with a PEO saves Company XYZ around $1,500 per year, per employee — and it costs $1,200 per employee. The difference between those two figures is $300. Finally, $300 divided by $1,200 equals 0.25 — making the ROI of using a PEO (in this specific example) an even 25%. Whether you have one employee or 100, the same formula applies.

See how much you could save with G&A Partners. Take our free HR Savings Assessment.

How many companies use PEOs?

Over 200,000 small to mid-sized companies (with a total of over 4.5 million worksite employees) currently use PEOs. That’s approximately 17% of all businesses that have between 10 and 99 employees. Since 2020, the PEO market size has steadily increased each year — and it’s projected to continue its steady growth through at least 2028.

How do I choose the best PEO for my small business?

With all of the options out there, it can be difficult to choose the best PEO for your small business. If you know what you’re looking for, though—and what’s most important to your business—you can narrow your options down.

Here’s a recommended checklist for evaluating PEO providers:

- Look for a provider who offers the customized and scalable HR solutions you need most (HR management, payroll processing, benefits administration, workplace safety, etc.).

- Compare each provider’s employee benefits offerings to see who truly offers Fortune 500-level benefits at an accessible price point.

- Determine whether a given provider possesses the expertise and experience to provide guidance as well as best-in-class customer service.

- Make sure the provider is well versed in your industry’s various regulations, to reduce and manage exposure to risk.

- Ensure that the provider’s HR management software is innovative, user-friendly, and will integrate seamlessly with your other business tools and technologies.

Why G&A

G&A Partners offers access to HR experts with years of experience helping businesses free up their bandwidth, implement streamlined HR processes and procedures to help save time and money. Schedule a consultation with one of our trusted business advisors to learn more.