Employee Programs: How to avoid rising health care costs

Avoiding rising health care costs is nearly impossible, but you can learn about why they continue to rise and what you can do to manage costs for your organization and your employees.

Factors leading to increased health care costs

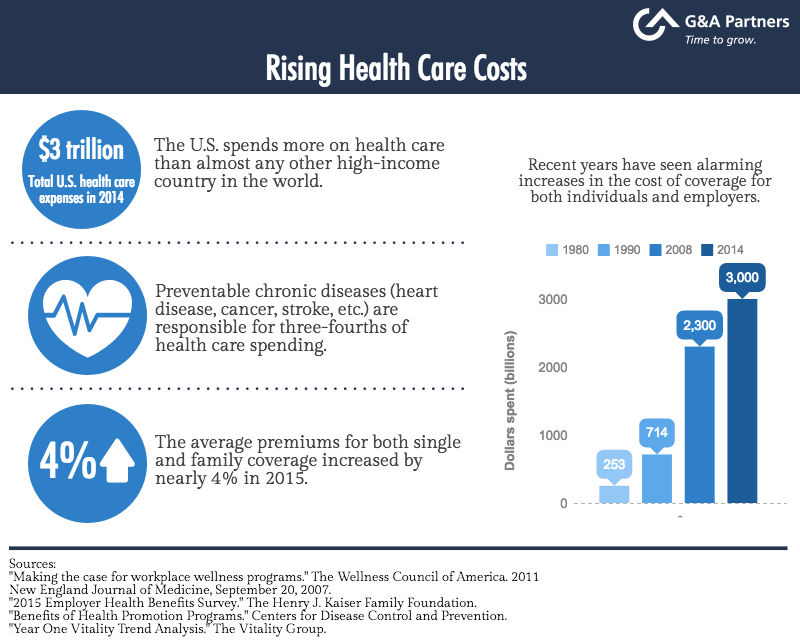

Health care costs, and consequently employee benefits costs, have been increasing at an alarming rate for nearly a decade. So why are U.S. health care costs skyrocketing?

Factors that have contributed to climbing health care costs over the past decade include:

- Demographics

- Expansion of health care providers

- Consolidation of managed care companies

- Political environment and government regulation

- Increased utilization and consumer demand

- New medical technology

- Weakening of managed care system

- Health care spending and medical cost inflation

- Increased prescription drug costs

The following are two factors that are also contributing to current and projected health care costs:

An aging population

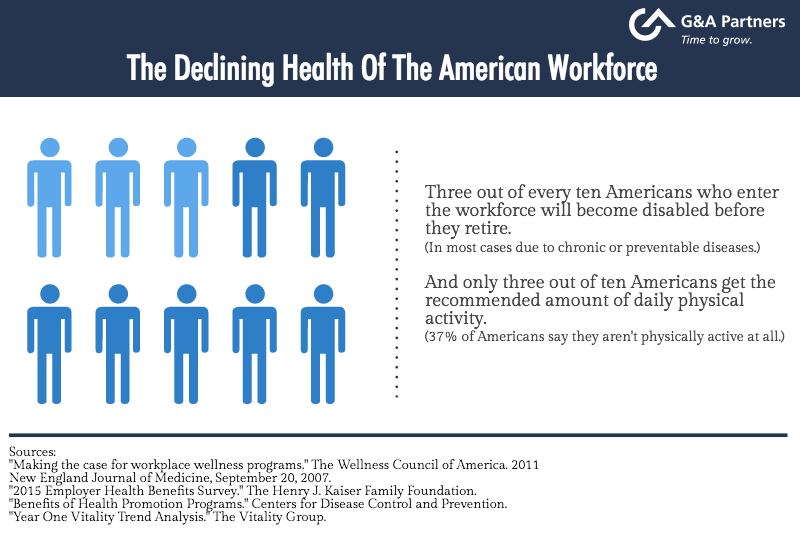

Slower hiring rates have resulted in an older workforce. Because older workers are more prone to health problems, companies are seeing a rise in chronic conditions, costly medical problems and the use of prescription drugs, as well as an increase in the amount and frequency of catastrophic claims.

Poor general health

Poorer health among Americans has also contributed to health care cost increases. Preventable risk factors such as obesity and high blood pressure have led to increases in chronic health conditions such as diabetes and heart disease—illnesses that are long-term and extremely costly. Unhealthy lifestyles can be addressed through wellness programs to improve employee health and reduce costs, but most savings are seen in the long term. To combat the continuing short-term increases, employers are passing more and more costs to employees through higher deductibles, copays and out-of-pocket maximum amounts.

Understanding why your annual health plan renewal rates may be significantly higher than in the previous year is the key to forming alternatives and solutions to your particular plan’s challenges. It is also important for educating your employees about the reasons behind any plan or contribution changes you may decide to introduce.

What can employers do to combat rising health care costs?

Employers are struggling to contain accelerating health plan costs. After trying to absorb most of the costs because of hiring and retention issues, many firms are attacking the root causes of rising costs with sustained, systemic changes. With the growing epidemic of poor health and the uncertain overall impact of health care reform, many employers are looking at both short- and long-term strategies to manage costs.

Using health care data to drive strategy

A Hewitt Associates survey found that employers cite using health care data to make strategic health plan decisions as their top cost-cutting strategy. However, the survey also discussed the importance of going beyond accessing data, and understanding how to apply it when making decisions and implementing strategic changes.

Greater emphasis on consumer-driven plans

An increasingly popular option in the health care industry is the adoption of consumer-driven health plans, typically involving a health reimbursement account (HRA) or health savings account (HSA). These plans offer cost-savings for the employer, but also benefit the employee. With proper education, employees can become smarter health care consumers, which can save both parties money.

Promoting employee health and wellness

Health and wellness initiatives have become another popular health care cost management strategy, and remain one of employers’ top cost containment strategies. As more and more employers are realizing that improving employee health and wellness can effectively lower health care costs and increase productivity, many are creating more comprehensive programs, targeting specific diseases and including dependents in the initiatives.

Incentives for participation are growing in popularity as well (including incentives for dependents), but it is important to use effective incentives. Rewarding employees for participating in a program or meeting a health goal is much more effective than incentivizing things like the completion of a health risk assessment. Many employers are also instituting penalties for non-participation or unhealthy behaviors, often in the form of higher premiums or additional employee cost-sharing. It is important to note that successful wellness and disease management initiatives are dependent on quality employee education and communication techniques.

Increased employee cost-sharing

Many employers are choosing to pass more costs to employees to handle tough increases; they are also choosing to restructure their health plans to incentivize lower-cost options. These are a few strategies employers are using:

- Moving from fixed-dollar copayments to a coinsurance model (employee pays a percentage of costs for each health care service)

- Increasing deductibles and out-of-pocket maximums

- Increasing employee cost-sharing for non-network providers

- Increasing employee cost-sharing for brand name prescription drugs to incentivize use of generics

- Offering consumer-driven plans, either as an option along with a traditional plan or as a total replacement

Dependent management strategies

Employers are finding huge cost-saving opportunities by changing the way they manage dependents. Dependent eligibility audits can save companies substantial amounts of money: Studies show that, on average, 5 to 15 percent of dependents are actually not eligible to be on the health plan. Many companies are also shifting to a per-member premium structure, rather than just “individual” and “family.” Another emerging trend is requiring spouses to pay more in premiums or assessing a surcharge to encourage spouses to enroll in their own employers’ plans.

Strategic vendor management

A recent movement involves companies aggressively evaluating their vendor relationships and replacing or eliminating those vendors that do not produce measurable results. Employers are also looking for opportunities to consolidate vendor relationships to get the most for their money.

Due to the financial pressure many employers are under, short-term tactics like employee cost-sharing are still prevalent. However, employers are exploring multi-year plans and longer-term initiatives to improve overall employee health and strategically manage costs in the future. Particularly in the wake of health care reform, many employers are becoming more concerned with developing strategies that are sustainable in keeping costs down.

How can employers determine which solution is right for their business?

Should you pass costs on to employees? Or should you try to manage costs in some of the other ways discussed in this article? Ultimately, it is a decision that you need to come to through thoughtful and detailed analysis of your plans and with the advice of your broker or consultant.

Below are some questions you can address in order to begin developing an effective strategy that is right for your organization.

- Are our program structure, plan design and pricing appropriate?

- Do we have the right vendors, services, contracting and funding in place?

- Are our employee communication efforts appropriate and effective, especially regarding employee health and wellness and/or consumerism?

- Do we have effective disease management and wellness programs for our employees?

- Do our pricing and plan design features encourage cost-conscious behavior on the part of our employees?

- Are we thinking about long-term solutions rather than quick fixes for this year?

It’s a fact: Health care costs and health benefit costs continue to increase at exceptionally high rates from year to year.

You want to continue to offer valuable health benefits to your current employees, and you want those benefits to help you attract and retain quality employees. However, you also need to consider the cost-effectiveness of those benefits at a time when hefty rate hikes are the norm.

Smart business owners understand that today’s top talent looks for more from companies than a mere job and paycheck. Health plans offer peace of mind for employees and their families, and savings plans can help provide a level of financial security now and in the future. But selecting the right combination and level of benefits for your employees can be overwhelming, not to mention that most “do-it-yourself” plans become extremely expensive and difficult to administer. G&A Partners can help.

Learn more about G&A Partners’ expert employee benefits administration services.

Why G&A?

G&A Partners has been a leader in the HR outsourcing industry for more than 25 years. We have experience across industries, providing unrivaled HR expertise, innovative technology, and reliable service that helps business leaders grow their business.